Police departments around the country are warning car owners about a resurgence in a particularly annoying and costly crime for victims: catalytic converter thefts.

In the past four weeks alone, police officials in at least 11 states from Delaware to California have cautioned car owners about an increase in reports of stolen catalytic converters and offered measures to help prevent thefts. And this surge in thefts is not exclusive to the U.S.

Police departments in major international cities including Vancouver and London are also notifying the public of an alarming rise in catalytic converter thefts.

Police are warning that thieves are targeting specific vehicles, such as the Toyota Prius and other hybrid cars. That’s because catalytic converters on hybrid cars are used less frequently, meaning the precious metals they contain are less likely to be corroded and more valuable as scrap.

A typical catalytic converter fetches over $100 at a recycling scrap yard. Larger catalytic converters can be sold for more — over $500 for the largest models.

Modern autocatalysts contain precious metals including palladium as a catalyst material, which has soared in price over the past 12 months. The price of palladium has broken price records week after week and approached $2,000 earlier this week to some media fanfare.

Palladium Price 1-Year

With such a meteoric rise in palladium prices, investors may be tempted to try to ride the wave higher. But please let us issue a warning of our own: Don’t bet on palladium prices heading much higher.

The number one application by a wide margin for palladium is autocatalysts. Approximately 85% of all the palladium mined and recycled right now ends up being used in a catalytic converter. However, palladium can be (mostly) replaced as the main catalyst material in autocatalysts with platinum.

Both palladium and platinum work well to essentially absorb harmful hydrogen and carbon emissions. So autocatalyst makers can use either as the main catalyst material in their products. And they do — they use both.

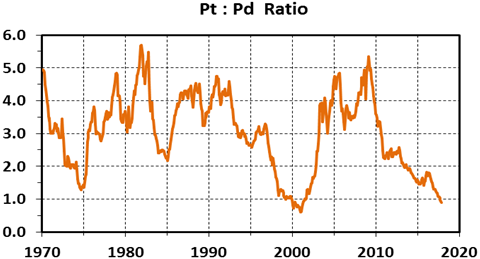

Considering manufacturing costs, autocatalyst makers will choose the less expensive between palladium and platinum to use in their products. This is reflected in a long-term inverse price relationship between palladium and platinum.

Generally speaking, at times when platinum prices are setting records, palladium prices are depressed into multi-year lows, and vice versa.

And that’s exactly where we find the market right now. While the price of palladium soars, platinum prices are sitting around 10-year lows.

Platinum Prices 20-Year

So what we can expect is this: Due to the soaring prices, autocatalyst manufacturers will very likely switch their catalyst formulas to include less palladium and more platinum. This is expected to result in rapidly falling palladium prices.

So, sell palladium.

I expect that in the near future, we’ll be looking back at the current surge in catalytic convertor thefts as what should have been a clear sign of a market about to top out.

Sell palladium.

But buy platinum.

Technically, platinum prices are at 10-year lows. But those prices set 10 years ago were the result of a major sell-off that coincided with the financial boom and bust of the mid and late 2010s. Platinum prices fell to nearly $800 at the time but, as you can see in the chart above, very quickly recovered.

In other words, very few people actually bought at that level. The last time platinum traded under $900 for any significant amount of time was prior to 2005 — George W. Bush was in office.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to is join our Energy and Capital investment community and sign up for the daily newsletter below.

So at just over $930 an ounce right now, platinum is cheap!

Folks interested in platinum, however, should note a few things…

First, and maybe most importantly, a platinum investment that will maximize returns will be long term. There’s no fast money here. If you take a look at long-term palladium prices, you’ll see that while the big spike in price is quite impressive, it took a long time to get there.

Palladium Price 20-Year

The price of platinum hit an all-time high of $2,275 an ounce very briefly back in March 2008. And there’s no reason it can’t climb back to that price, or inflation-adjusted levels nearing $3,000 an ounce. But it will take a good bit of patience.

The next most important thing investors should note about platinum is there are limited investment options — many of which can face liquidity issues.

The most traditional way to invest in a precious metal is by owning the physical bullion. But platinum isn’t really a traditional precious metal. In fact, the first-known uses of platinum were actually as a cheaper substitute to make counterfeit silver coins and as an alloy for mixing with gold to produce counterfeit gold coins. It was a filler material.

The market for platinum bullion today is still very thin. The U.S. Mint reports it has sold 152,000 ounces of American Gold Eagles and 14.8 million ounce of Silver Eagles so far this year.

As for Platinum Eagles, the Mint has sold a total of 40,000 ounces this year. Platinum bullion simply isn’t in high demand.

On the resale side, the ratio of Gold and Platinum Eagles is remarkably similar to Mint sales. As of today there are 3,748 results on eBay for “American Gold Eagle” and only 1,059 for “American Platinum Eagle.”

Such a small market will inevitably lead to liquidity issues for some.

Physical platinum bullion is also expensive compared to gold or silver bullion. Premiums for many platinum coins can easily exceed 20% of melt value, while gold premiums average closer to 5%.

All in all, investing in physical platinum bullion has obvious flaws. But it is the purest and easiest way for most people.

Of course, there are mining stocks. But platinum is very rare relative to gold. Gold mining produces between 2,500 and 3,000 tons annually. Meanwhile, the annual supply of platinum is only about 130 tons — or only 4% or 5% (by weight) of the world’s total annual mine production.

So there aren’t really that many companies producing platinum. And even fewer are public.

The 800-pound gorilla of the platinum industry is Anglo American Platinum Ltd. (OTCMKTS: AGPPF). The South African mining company is the world’s largest primary producer of platinum, accounting for about 40% of the world’s annual supply.

Other major public platinum producers include Impala Platinum (OTCMKTS: IMPUY) and… well, that’s pretty much it.

Both Anglo and Impala mine other metals, including palladium. So even though we may consider these stocks as having upside for rising platinum prices, they also have downside in regards to falling palladium prices.

Platinum ETFs and ETNs are also an option. But those products are best used for short-term trading. And trading futures contracts typically involves more effort than most people are willing to put in. So there really aren’t a lot of great options for platinum investors.

I think the best way for most people to approach a platinum investment right now is with restrained expectations. Investing in platinum alone isn’t going to make you rich — don’t go all in or even close to it expecting a huge payday.

Instead, buy a little physical platinum bullion — despite its flaws I mentioned — and put it away for a few years to seek a decent long-term return.

A decade and a half of buying and selling metals has taught me also that the best way to approach any physical bullion purchase is to keep it simple. Don’t be drawn in by coin designs or any other nonsense. Instead, when buying physical bullion, it’s most important (in a pragmatic sense at least) to consider where you’re going to sell it when divested times come — especially with platinum.

The #1 platinum bullion coin on the market today is, in my opinion, simply the American Platinum Eagle.

Platinum Eagles are a bit more expensive than other platinum bullion options. But they are easily the most liquid and will retain some of their premium at divestment time.

Platinum Eagle coins can be found in fractions down to 1/10 of an ounce. However, fractional Platinum Eagles can have extremely high premiums, with some dates even being targeted by collectors for their rarity. So the standard one-ounce Platinum Eagles are really the best option for investors.

Buy a few American Platinum Eagles and stick ’em away.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.